If you own a small business, one of the most important pieces of equipment you have is your accounting software. The software can help you keep track of your finances, manage customer relationships, and more.

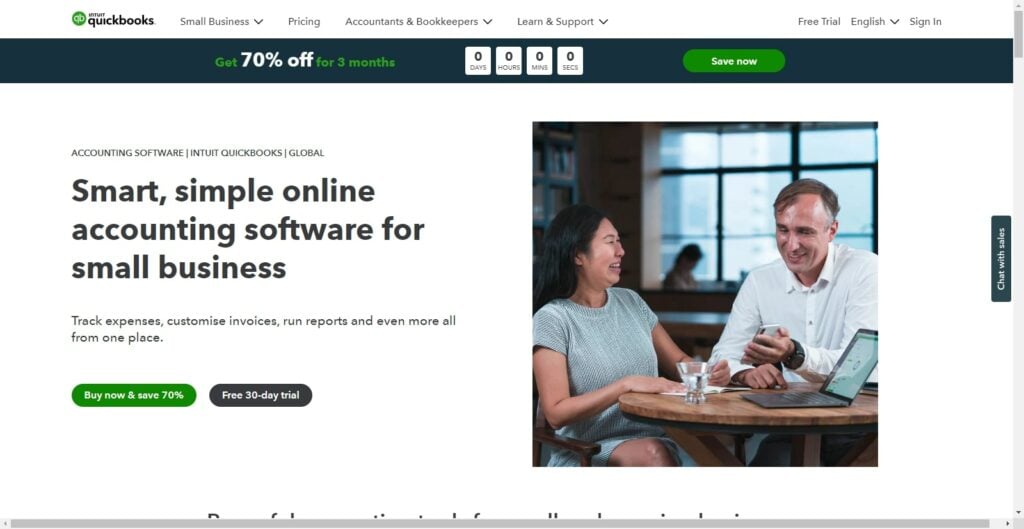

Small businesses have plenty of accounting and bookkeeping software options, but which is right for them? QuickBooks Online is a popular choice for various reasons.

However, there are other QuickBooks alternatives out there that might be a better fit for your business and budget. In this series, we’ll explore the 8 best QuickBooks alternatives for small business owners that you might want to consider for your accounting needs.

Why QuickBooks Online?

QuickBooks Online is an accounting software that allows you to manage your finances and keep track of business matters from your computer or smartphone at any time.

It’s renowned for its intuitive features like project management, bill management, and more. These help businesses track leads, manage demand, schedule appointments, and communicate with customers.

Businesses choose QuickBooks accounting software because it’s easy to use and customizable, making it easy to operate with any inventory.

Key Features of QuickBooks include:

- Full-service payroll to track hours, payroll taxes, and payments

- Commerce features to manage and track inventory and sales and handle customer orders

- Project management, sales and inventory management, and loan oversight

QuickBooks is a popular accounting software designed for small and medium-sized businesses that allows users to track income and expenses, create invoices, manage bills and payments, and generate financial reports. It also offers features such as inventory management, payroll processing, and tax preparation. It is widely used by businesses across various industries and is known for its reliability, accuracy, and ease of use.

- User-friendly interface

- Time-saving features such as automatic data entry, automatic bank feeds, and automatic invoicing

- Customizable reports

- Integration with other software

- Cloud-based access

- Multi-user access

- Automatic backups

Why Look for QuickBooks Alternatives?

Businesses may look for QuickBooks alternatives if they need advanced features to handle large amounts of data or a more affordable option.

Large businesses may prefer a faster tool to cope with their growing needs. QuickBooks limits managers on users they can onboard. This may be an issue for growing companies.

Top QuickBooks Alternatives

Here are 8 best QuickBooks alternatives that can help you with your bookkeeping needs:

- FreshBooks: Better than QuickBooks in invoicing and overall user interface.

- Zoho Books: Better than QuickBooks in client portals and management.

- OnPay: Better than QuickBooks in HR automation.

- Bonsai: Better than QuickBooks in accounting and data collaboration.

- Oracle NetSuite Cloud Accounting Software: Better than QuickBooks in integrated sales and customer management.

- Wave: Better than QuickBooks in sales and customer management.

- Sage Intacct: Better than QuickBooks in integration.

- ZarMoney: Better than QuickBooks in accounting management.

FreshBooks

FreshBooks is a bookkeeping tool that provides small business invoicing, sales, and customer management. It allows you to access accounting books from anywhere and helps your clients track orders, contact team members, and manage job listings.

Freshbooks is a one of the best accounting software designed for small businesses and freelancers. It provides a range of features including invoicing, time tracking, expense management, project management, and financial reporting. The software also integrates with popular payment gateways, making it easy for users to receive payments from clients. Freshbooks is user-friendly and offers a mobile app for on-the-go access. It is a reliable and efficient tool for managing finances and streamlining business operations.

- Create and send professional-looking invoices

- Track time spent on projects

- Manage expenses

- Generate financial reports

FreshBooks Features

Key features of FreshBooks include:

- An invoicing tool fully integrated with email, social media accounts, and a billing system.

- Automatic updates and automatic expenses entry

- A mobile app that allows remote access to accounting books

- Fantastic customer support, user interface, and easy navigation tools

FreshBooks Pricing Plans

- Lite: costs $4.5 per month and is most suitable for self-employed people, offering you invoices and five billable clients but no payroll.

- Plus: costs $9 per month and is most suitable for small businesses, offering you invoices, daily sales reports, and up to 50 billable clients.

- Premium: costs $16.5 per month and is best for growing businesses, offering invoices, daily sales reports, customized client portals, and 500 billable clients.

QuickBooks Online vs. FreshBooks – Why is FreshBooks better?

FreshBooks has an easier-to-use interface than QuickBooks. It also offers mobile apps that you can use to access your accounting books from anywhere.

FreshBooks is more User-Friendly

FreshBooks has a more user-friendly interface, making it much easy for beginners to navigate. Unlike QuickBooks, FreshBooks is easy to manage and use. It focuses on making invoicing and accounting easy for businesses.

FreshBooks Wins in Invoicing

FreshBooks is better at invoicing. It allows you to integrate invoices on your website, social media accounts, and email. It also automatically updates itself and does the automatic entry of your expenses. Using FreshBooks, you can also track the status of your invoices in real time.

Who is FreshBooks For?

FreshBooks is meant for freelancers and small business owners that want more intuitive and easier-to-use accounting software. It’s also an excellent solution for businesses with growing invoicing and sales needs.

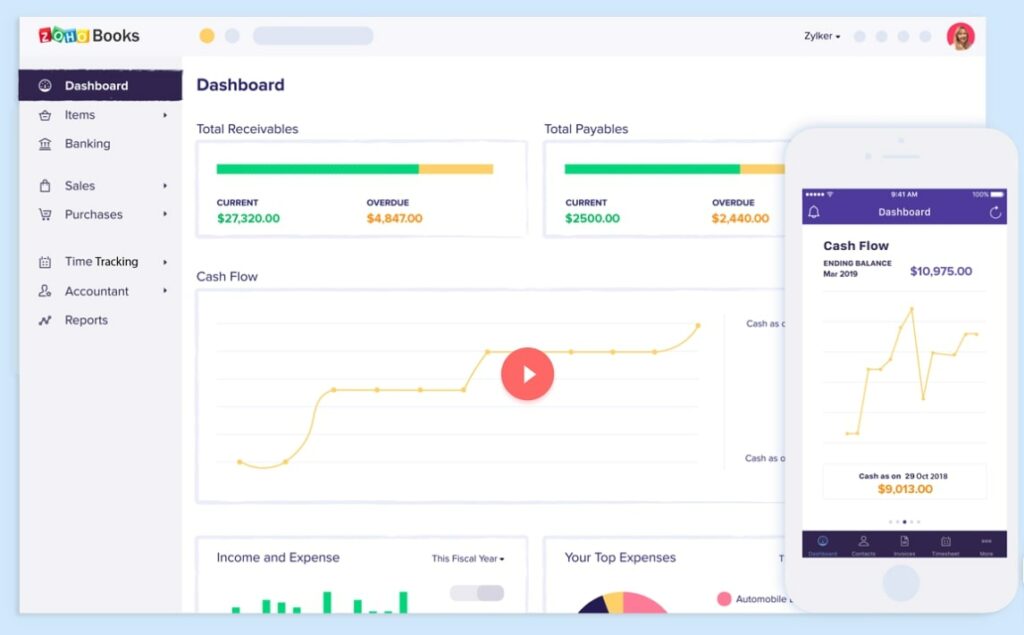

Zoho Books

Zoho Books is an accounting software for managing finances, contacts, and projects in one place. It helps you automate workflows, negotiate deals, and manage department tasks.

The software allows you to create powerful invoices and track time while accepting online payments. It also offers tax compliance and tax and reporting forms.

Zoho Books is a cloud-based accounting software that helps businesses manage their finances efficiently. It offers a range of features such as invoicing, expense tracking, inventory management, and financial reporting. With Zoho Books, users can easily create and send professional invoices, track payments, and manage their cash flow. The software also allows users to automate recurring transactions, reconcile bank accounts, and generate financial statements. Zoho Books is designed to be user-friendly and accessible, even for those without accounting experience. It is an ideal solution for small and medium-sized businesses looking to streamline their financial operations and improve their bottom line.

- User-friendly interface: Zoho Books has a simple and intuitive interface that makes it easy for users to navigate and use the software.

- Comprehensive features: Zoho Books offers a wide range of features that cover all aspects of accounting, including invoicing, expense tracking, inventory management, and financial reporting.

- Customizable templates: The software provides customizable templates for invoices, estimates, and other documents, allowing users to create professional-looking documents that reflect their brand.

- Integration with other Zoho apps: Zoho Books integrates seamlessly with other Zoho apps, such as Zoho CRM and Zoho Inventory, providing users with a complete business management solution.

- Multi-currency support: Zoho Books supports multiple currencies, making it easy for businesses to manage transactions with customers and vendors in different countries.

- Mobile app: Zoho Books has a mobile app that allows users to manage their accounting tasks on the go.

Zoho Books Features

The top features of Zoho Books are:

- It has invoices, manages sales, and tracks time features while allowing you to accept online payments.

- It has a client portal that allows your customers to view their transactions in one place.

- The banking feature allows you to compile and easily reconcile your accounts.

- The automatic tax filing features allow you to generate and send the forms to your clients.

- It has a scheduling feature that lets you schedule reports to maximize your business.

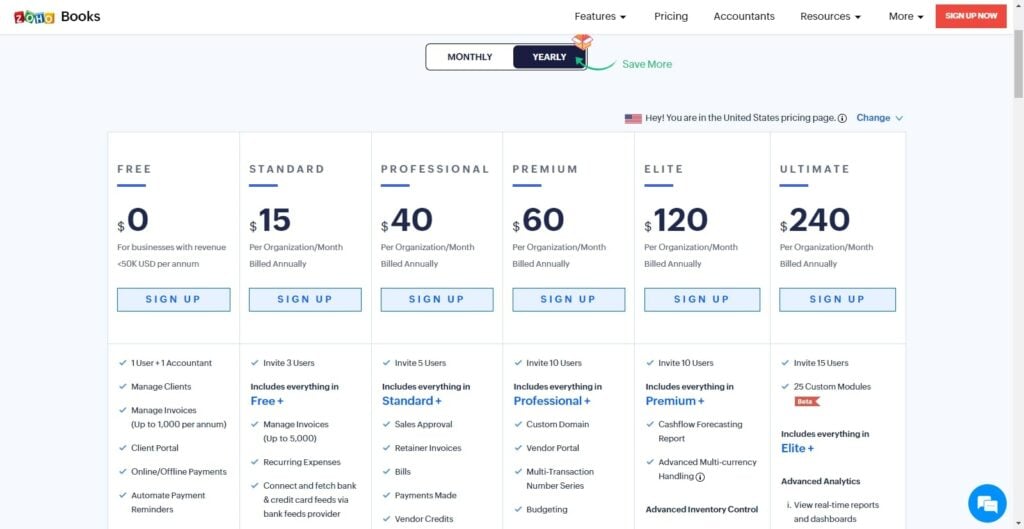

Zoho Books Pricing Plans

- Free: costs $0 and allows access to the client portal, managing invoices, access to annual journals and reports, and can be used by a user and an accountant.

- Standard: costs $20 per organization monthly for basic work, offers predefined user roles, bulk updates, and transaction locking, and can accommodate up to 3 users.

- Professional: costs $50 per organization monthly, offers you sales approval, vendor credits, and basic multi-currency handling, and can accommodate up to 5 users.

- Premium: costs $70 per organization monthly, offers vendor portal, web tabs, and 200 workflow rules, and can accommodate up to 10 users.

- Elite: costs $150 per organization monthly, offers cashflow forecasting reports and advanced inventory control, and you can invite 10 users.

- Ultimate: costs $275 per organization in a month, allows you to customize reports and dashboards, analyze and track significant financial metrics, and you can invite 15 users.

QuickBooks Online vs. Zoho Books – Why is Zoho Books Better?

Zoho Books is easier to use and has mobile apps, allowing you to access your accounts from anywhere. It also has automated tax forms to help you file taxes easier.

Zoho Books Wins in Exceptional Mobile App

Zoho Books has a better mobile app for business owners. It is simple, easy to use, and well-designed. It allows you to bill, track time, and manage your contacts and clients anywhere, making it easier for you to stay on top of your accounting.

Zoho Books Beat QuickBooks in Client Portal

Zoho Books has a better client portal that allows clients to track orders, view invoices, and more. QuickBooks lacks this feature.

It allows clients to communicate with team members and manage job listings from the portal. Zoho Books will enable you to send custom invoices with your logo and clients’ names.

Who is Zoho Books for?

Zoho Books is a better QuickBooks alternative for small and medium-sized businesses that want to manage their finances, clients, contacts, and projects in one place.

It’s great for growing small businesses, as it allows them to manage their accounting, clients, and projects from any device.

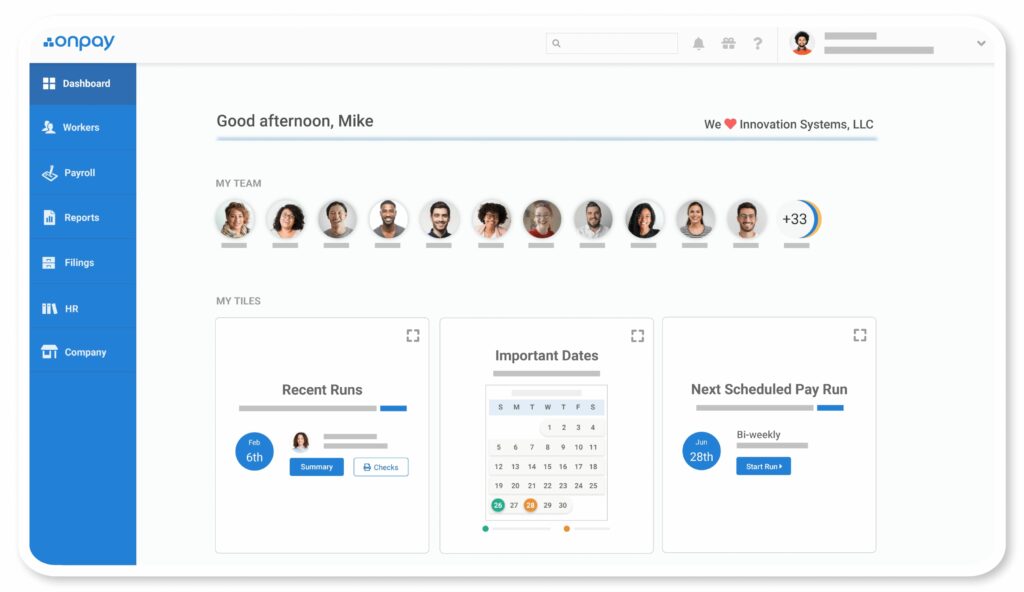

OnPay

OnPay is a complete end-to-end business management solution for small businesses offering HR, payroll, and invoicing solutions. It provides fast, precise, and backed payroll service, all the HR busywork, and in-house benefits in one place.

The software allows businesses to manage employees, payroll, and expenses. It also offers several built-in features to help enterprises to manage their finances better.

OnPay is a cloud-based payroll and HR software that simplifies the process of managing employee payroll, benefits, and taxes. With OnPay, businesses can easily calculate and process payroll, generate pay stubs, and file taxes. The software also offers a range of HR tools, including time tracking, employee self-service, and compliance management. OnPay is designed to be user-friendly and affordable, making it an ideal solution for small and medium-sized businesses. The software is accessible from any device with an internet connection, allowing businesses to manage their payroll and HR tasks from anywhere. Overall, OnPay streamlines the payroll and HR process, saving businesses time and money while ensuring compliance with all relevant regulations.

- User-friendly interface: OnPay has a simple and intuitive interface that makes it easy for users to navigate and use the software.

- Affordable pricing: OnPay offers affordable pricing plans that are suitable for small businesses and startups.

- Comprehensive payroll features: OnPay offers a wide range of payroll features, including tax filing, direct deposit, and employee self-service.

- Automated payroll processing: OnPay automates the payroll process, which saves time and reduces the risk of errors.

- Excellent customer support: OnPay provides excellent customer support through phone, email, and live chat.

- Integration with other software: OnPay integrates with other software, such as accounting and time-tracking software, to streamline the payroll process.

OnPay Features

Key features of OnPay include:

- A payroll feature to manage employee timesheets, paychecks, direct deposits into bank accounts, and more

- An automatic tax payment feature to automatically pay taxes and generate tax forms for your clients

- API integrations feature to integrate your accounting software with other programs.

- Customization features to customize your invoices and reports easily.

OnPay Pricing

The best thing about OnPay is that it offers a free trial for your first month. From there, you pay $40 +$6 per person per month, and you get unlimited monthly pay runs, a complete set of HR tools, and unrestricted migration from your old provider.

QuickBooks Vs. OnPay – Why is OnPay Better?

OnPay has an in-house HR team, where you hire a separate HR department. You will get a complete set of HR tools and features that you can use to streamline your HR department.

OnPay will automate your payroll, allow you to create programs that automatically pay taxes, and generate tax forms for your clients.

OnPay beats QuickBooks in HR Automation

OnPay has an in-house HR team. You can take advantage of the customizable features to attract and hire the best employees from across the globe. It will automate your payroll, automatically pay taxes, and generate tax forms for your clients.

Who is OnPay for?

OnPay is ideal for businesses that need a fully-fledged HR solution. If you need to manage your employees, automize payroll, and manage your finances and taxes, then OnPay is the best solution.

Bonsai

Bonsai is a cloud-based software that helps companies and contractors work better together. It allows you to manage your contracts, proposals, taxes, invoice, time tracking, and multiple projects from one place.

You can easily attain your client’s contact details and track their orders via a simple and easy-to-use user interface.

Bonsai Features

Key features of Bonsai include:

- Proposals feature to create and send proposals to your clients easily.

- A tax form feature to create tax forms from the invoice and automatically generates them for their clients.

- A multiple invoices feature to send different invoices to your clients and track the time for each one.

- A legalized-contracts feature to create legal contracts for your clients.

Bonsai Pricing

- Start: costs $24 per month and offers contacts, unlimited clients, multiple invoices, and tax forms.

- Advanced: costs $39 per month and provides workflow automation, Calendly integration, client and custom fields, and more.

- Pro: costs $79 per month and offers a talent pool, subcontractor onboarding, accountant access, and unlimited project collaborators.

QuickBooks Online vs. Bonsai – Why is Bonsai better?

Bonsai users can create and send legal contracts usable in court. You can create different invoice templates for your clients. Bonsai is also scalable, allowing you to use it for multiple projects without creating an individual account for each project.

Bonsai Wins in Client Management

Bonsai allows you to manage multiple clients simultaneously and send different invoices to each client. It also allows you to create tax forms from the invoices and automatically generate them for your clients.

Bonsai has an in-built task-tracking feature that will enable you to track time on your tasks and multiple projects.

Bonsai Beats QuickBooks in Subcontracting

Bonsai has a subcontractor onboarding feature that allows you to invite subcontractors and track their time and projects. You can take their input and complete your projects on time.

Bonsai allows you to manage your subcontractors and get them involved in your projects.

Who is Bonsai for?

Bonsai is the most fitting QuickBooks alternative for freelancers who want to manage multiple clients, tasks, and processes from one place. If you have different projects from international and local clients

and subcontractors, then Bonsai is right for you.

Oracle NetSuite Cloud Accounting Software

Oracle NetSuite is an Enterprise Resource Planning (ERP) and accounting software that helps you increase your revenues and improve your cash flows.

It allows you to manage and track multiple clients, vendors, and subcontractors in a single platform. It runs in the cloud and allows you to update your software from anywhere.

Oracle Netsuite Accounting is a cloud-based accounting software that provides businesses with a comprehensive suite of financial management tools. It is designed to streamline accounting processes, automate financial operations, and provide real-time visibility into financial performance. With Oracle Netsuite Accounting, businesses can manage their financials, inventory, billing, and invoicing, as well as track expenses, generate financial reports, and manage cash flow. The software is highly customizable and can be tailored to meet the specific needs of businesses of all sizes and industries. Its user-friendly interface and intuitive navigation make it easy for users to access and manage financial data from anywhere, at any time. Overall, Oracle Netsuite Accounting is a powerful tool that helps businesses stay on top of their finances and make informed decisions to drive growth and profitability.

- Comprehensive financial management: It provides a complete suite of financial management tools, including general ledger, accounts payable, accounts receivable, and fixed assets management.

- Scalability: It is designed to grow with your business, providing the ability to add new users, features, and functionality as your needs change.

- Customization: The platform is highly customizable, allowing users to tailor the system to their specific business needs and workflows.

- Integration: It integrates seamlessly with other Oracle Netsuite products, as well as with third-party applications.

- Real-time reporting: With real-time reporting capabilities, Oracle Netsuite Accounting provides users with up-to-date financial data, allowing for better decision-making and improved financial management.

- Security: It is built with robust security features, including data encryption, access controls, and regular security updates, ensuring the safety and privacy of your financial data.

Oracle NetSuite Features

Key features on Oracle NetSuite include:

- HR tools to find, grow and retain your clients.

- A manufacturing management feature to track the business on a detailed level

- Product technology and tools to oversee your customers and prospects

- Purchasing management tools to help you identify the costs of your business.

- CRM tools to help you manage the lifecycle of your business.

Oracle NetSuite Pricing

Oracle NetSuite isn’t transparent about its pricing plans. They offer numerous services; you must contact support for more information to request a pricing quote for a particular service or a full quote.

QuickBooks Online vs. Oracle NetSuite – Why is Oracle NetSuite Better?

Oracle NetSuite has enterprise resource planning features and allows you to manage various applications. It uses the on-premise model, which runs on your environment.

Oracle NetSuite also has a human resource feature that allows you to manage your staff, projects, and vendors from one place.

Oracle NetSuite Wins in Customer Relationship Management (CRM)

Oracle NetSuite has a CRM feature that allows you to manage your contacts and clients. It allows you to create various contact types to separate your contacts.

Oracle NetSuite has a management and portfolio report feature that will enable you to manage your investor relations with the help of GTM-GTM lines, ROI, and sales forecast.

Who is Oracle NetSuite for?

Oracle NetSuite is best suited for large businesses with complex accounting requirements. It is good for financial institutions, consulting firms, advertising agencies, and law firms.

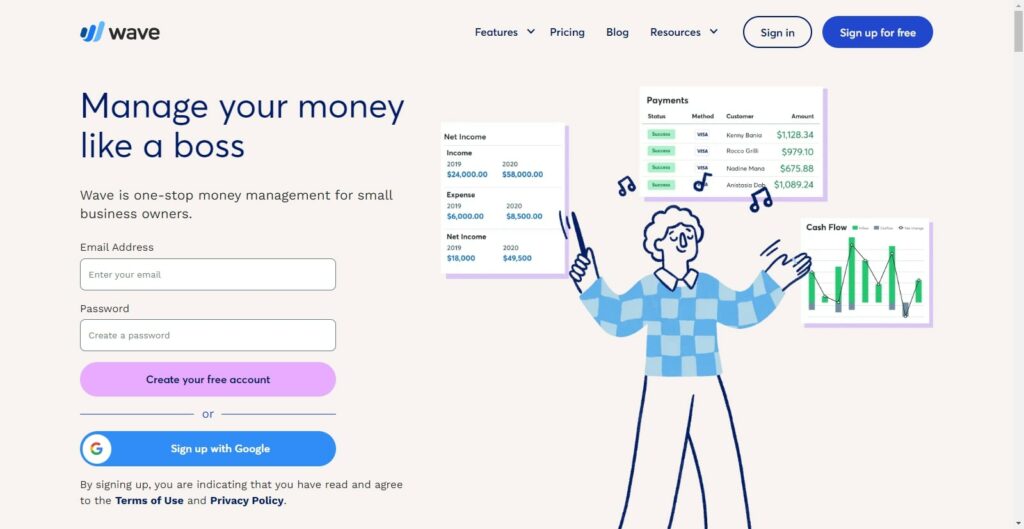

Wave

Wave is a cloud business management software that aims to streamline your bookkeeping, accounting, and taxes.

You connect to it via the internet and can access it anywhere. It is designed to help small business owners with bookkeeping, invoicing, and accounting requirements for free.

Wave Accounting Features

Key features of Wave Accounting include:

- A reconciliation tool to help you collect payments, bills, and receipts

- An invoicing feature to create, send and manage your invoices

- Customizable templates and built-in email integration tools to contact clients

- Other tools like expenses trackers, purchase orders, direct deposit, and automatic payment collection

Wave Pricing

Wave is a free accounting software that offers its services without charge. However, there are other wave products with upgrade plans. These include payroll and advisors plans, which cost $40 and $149 per month.

QuickBooks vs. Wave – Why is Wave better?

Wave is powerful, free, and has most features that small businesses need from accounting software. It has a simple design and a friendly user interface that makes it easy to use.

Wave Wins in Affordability

Wave is a free cloud accounting software that allows you to manage small business operations without charges. On the other hand, you must pay to use QuickBooks.

Wave also wins in terms of affordability. For people who choose to upgrade the software, the charges are less than normal Quickbooks charges.

Wave Beats QuickBooks in a User-Friendly Interface

Wave has an easy-to-use interface designed for all users. The features are easy to understand, and the dashboard is easily navigable. Wave is more intuitive and enables users to easily manage payroll, accounting, invoicing, and banking.

Who is Wave for?

Wave is most suitable for small business owners and freelancers who want to manage their financial operations without charges.

It’s also good for small businesses that want to streamline their bookkeeping, invoicing, and payments.

Sage Intacct

Sage Intacct is a full-featured business management software that offers ERP, accounting, and financial services.

It ensures businesses make the right decisions with accurate and timely information. It also integrates well with third-party solutions such as POS, ADP, payroll, and financial statements, which are critical to your business strategy and success.

Sage Intacct Features

Key features you’ll find on Sage business cloud include:

- A dashboard that allows you to monitor your profit and loss while checking the sales and inventory reports.

- Bank reconciliation feature to download your bank data and easily reconcile it with your accounts.

- A multi-currency feature that lets you set up your currency and get a real-time exchange rate.

- A performance management feature that allows you to track your sales and funnel growth.

- An inventory management feature to track your inventory items, transfer inventory between locations and reconcile inventory levels.

Sage Intacct Pricing

Sage business cloud-based solution offers myriad services that don’t provide a full-pricing quote. You must register for an account to access the pricing structure. Alternatively, you can contact customer support for more information.

QuickBooks Online vs. Sage Intacct – Why is Sage Intacct better?

Sage Intacct gives your business comprehensive ERP, Accounting, and financial solutions. It helps keep accurate information and gives you power over all the data collected on the system.

Sage Intacct is scalable, helps your business grow with time, and meets your ever-changing business needs.

Sage Intacct Beats QuickBooks Online in Integrations

Sage Intacct integrates nicely with other popular software solutions such as ADP payroll, POS, financial statements, etc.

With Sage Intacct, you can seamlessly manage your accounting, financial, and operations activities with these popular solutions.

Who is Sage Intacct for?

Sage Intacct is for small to medium-sized businesses looking for comprehensive, scalable, and robust accounting solutions.

It unifies your accounting, finances, and operations activities and provides you with a visual dashboard.

ZarMoney

ZarMoney is among the leading accounting software to manage your business operations efficiently.

It offers enterprise-level solutions with all the features of small business accounting software and provides powerful tools to meet your business needs.

It has a modern and user-friendly design that allows you to navigate it easily.

ZarMoney Features

The top features of ZarMoney include the following:

- CPA firms, Accountants, and other financial service providers can offer your business a better accounting solution.

- An easy-to-use interface to easily manage your finances and accounting activities.

- Accounts receivable feature to create invoices, view the outstanding balance, send reminders, and get paid.

- Inventory and bar code feature to manage your inventory and create and sell products.

ZarMoney Pricing

- Entrepreneur: costs $15 Per month and offers unlimited user transactions, invoices, and billing.

- Small Business: costs $20 per month and offers two users and $10 for any additional person with inventory and barcode features.

- Enterprise: costs $350 per month and supports over 30 users, offering 100 transactions, unlimited invoices, barcodes, and inventory features.

QuickBooks Online vs. ZarMoney – Why is ZarMoney better?

ZarMoney will offer more productivity and solution to your business needs since it has a more advanced feature than QuickBooks.

It has a better and more user-friendly interface that allows you to manage your finances and accounting activities easily. ZarMoney is also available at an affordable price that can meet your business’s financial needs.

ZarMoney Wins in Accounting Program

ZarMoney has a more comprehensive accounting solution for your business. It unifies your accounting, finances, and operations activities so that you can save money and time.

ZarMoney also provides you with the unique features of barcode and inventory that helps you manage your inventory effectively.

Who is ZarMoney for?

ZarMoney is most suitable for small to medium-sized businesses looking for accounting software to help them manage their finances and accounting activities.

It offers you the unique features of barcode and inventory management, which allows you to manage your inventory, increase sales and grow your business.

Conclusion

The above best QuickBooks alternatives for small businesses can handle your accounting, finances, and operations activities. Choose the tool you think is good enough to meet your business needs.

The correct accounting software will improve your overall efficiency and functionality. Go through each of their official websites to find out what they offer and how they can help you above meet your business needs.