Customer Relationship Management (CRM) software is designed to automate and simplify the entire insurance workflow. It can help insurers better manage customer interactions and data, streamline billing processes, and improve communication between employees.

There are many CRM options for the insurance sector; however, choosing the best CRM software for you will depend on your specific business requirements. Below, we take a closer look at the top CRM software for the insurance industry and explain which features you can expect to find in each solution.

What Is An Insurance CRM?

Insurance CRM Software helps your business manage all of your customers’ information in one centralized location. It can be used to store contact information, track their sales history, and identify their needs and preferences so that you can provide them with the most relevant offers.

Insurance agents and insurance brokers can use CRM solutions to manage sales pipelines more effectively, improve customer service, and reduce processing times. The right CRM tool will help you identify the most important leads in your pipeline, prioritize them based on current business needs, and close more deals in less time.

Why Is CRM Important For Insurance Agents And Insurance Brokers?

CRM software for insurance agents provides key insights into the performance of your sales teams and helps track your performance against key business metrics. By allowing you to generate meaningful reports, it can help you measure and track the success of your marketing campaigns and identify opportunities for improvement.

Key Features of Insurance CRM Software

The key features of the best insurance CRM software will vary from one provider to the next, but there are a few common features that you should consider when choosing a software solution for your business. These include:

- Lead management:

CRM systems provide powerful tools for managing incoming leads and promoting your brand to prospective customers. You can use a lead management system to record information about your leads and ensure that they are followed up in a timely manner. - Customer service:

As insurance brokers and agents, your ability to offer excellent customer service can make or break your business. Many CRM platforms allow you to record client details, create tickets for inquiries, and provide customer support. - Workflow automation:

Workflow automation tools help insurance agents streamline the sales process and improve efficiency. These applications enable users to automate tasks such as emails and follow-ups, and they make it easier to perform complex calculations such as commission estimates. - Business intelligence:

High-quality CRM systems provide users with detailed reporting and analytics tools that help them monitor their progress and evaluate their business performance.

15 Best Insurance CRM Software

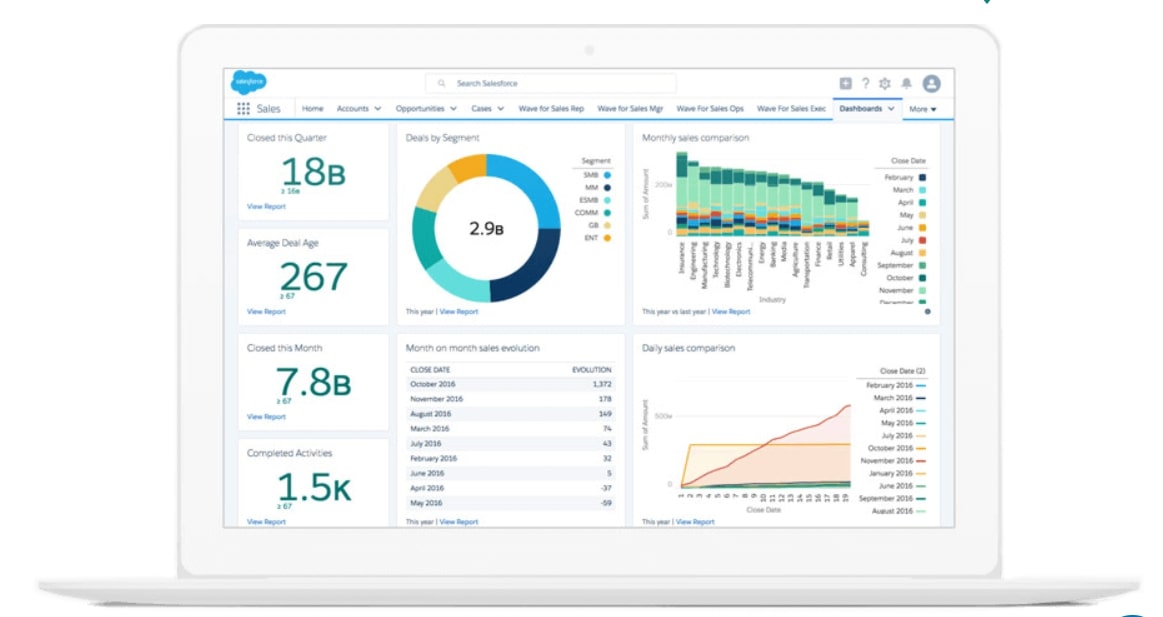

Salesforce

Salesforce has been in the CRM business for over 30 years and has become one of the top CRM software in the market, due to the platform’s wide set of advanced features, customization options, and hundreds of apps and integrations available via the AppExchange.

Although Salesforce has many products under its belt, you can find the insurance CRM software within the platform’s Financial Services Cloud.

Top Features

- Policy management tools

- Self-service portals for policyholders

- Lead management tools

- Automated workflows

- In-depth reports and analytics

Pricing

Salesforce’s insurance CRM can be found in the Financial Services Cloud, which covers four pricing plans:

- Starter – Enterprise Edition: $225 per user per month

- Starter- Unlimited Edition: $375 per user per month

- Growth – Enterprise Edition: $300 per user per month

- Growth – Unlimited Edition: $450 per user per month

Note that all pricing plans are billed annually. There’s also a 14-day free trial available. Although the standard CRM is found in the Sales Cloud, the Financial Services Cloud also includes features borrowed from Salesforce Sales Cloud and Services Cloud.

As such, you get access to the platform’s CRM, customer service tools, and other financial-oriented functionalities, hence the price.

Why Use Salesforce For Enhancing Customer Experience?

The platform provides all the tools necessary to create a top-notch customer experience. For instance, you can create customer self-service portals and personalize customer interactions via Salesforce Communities.

What’s Missing?

The platform is quite pricey, making it unsuitable for small insurance companies.

Oracle Netsuite

Like Salesforce, Oracle also has a wide array of products that integrate seamlessly with one another. Moreover, the platform’s dedicated insurance CRM excels in terms of automation, forecasting, and revenue management.

Top Features

- Policy and billing processing

- Loyalty and insurance management tools

- Sales automation and automated follow-ups

- Customer support portals

- Lead management tools

Pricing

Pricing is not disclosed. You’ll have to contact the sales team to get a quote. Also, note that the CRM requires a yearly subscription which also includes other Oracle products.

Why Use Oracle NetSuite For Increasing Customer Loyalty?

Oracle NetSuite CRM offers a plethora of customer-oriented functionalities. Oracle includes plenty of customer self-service tools and allows for automated workflows and personalized policyholder responses across multiple channels.

The platform also offers in-depth reports and analytics to help you have a better understanding of your target audience.

What’s Missing?

Since the insurance CRM comes bundled with other products, this platform may not be the best value for money. Additionally, Oracle NetSuite has a high learning curve.

Pipedrive

Pipedrive is a straightforward CRM software specifically designed for small businesses. The platform emphasizes ease of use, customization, and automation tools. As such, this is a suitable CRM for insurance agents looking for an easy-to-use solution to help them get work done fast.

Top Features

- Workflow automation

- Deal tracking

- Lead and contact management

- Sales pipeline management

- AI-powered tools

Pricing

- Essential: $19.90 per user per month (monthly), $14.90 per user per month (yearly)

- Advanced: $34.90 per user per month (monthly), $24.90 per user per month (yearly)

- Professional: $59.90 per user per month (monthly), $49.90 per user per month (yearly)

- Enterprise: $119.90 per user per month (monthly) $99 per user per month (yearly)

There’s also a 14-day free trial available across all pricing plans.

Why Use Pipedrive for Sales Process Optimization?

The platform’s easy-to-follow dashboard, coupled with its automation tools and customization options, makes it easy to identify bottlenecks in the sales process, automate monotonous tasks, and customize it, so it better fits your needs.

Additionally, Pipedrive comes with a plethora of integrations, like Slack and GravityForms to help you streamline your work even further.

What’s Missing?

The platform lacks customer support portals, while some handy features, like document management and centralization, come as extra add-ons.

monday.com

Monday Sales CRM, part of Monday.com’s suite of products, is also a CRM platform designed with small businesses in mind. This CRM software solution excels in ease of use and customization capabilities.

The platform comes with plenty of industry-specific templates to help you get started faster and tweak the CRM to fit your needs.

Top Features

- Lead and contact management

- Customizable sales pipeline

- Activity management

- Quote management

- Team collaboration

Pricing

- Individual CRM: $0 for two users

- Basic CRM: $12.5 per user per month (monthly), $10 per user per month (yearly)

- Standard CRM: $17 per user per month (monthly), $14 per user per month (yearly)

- Pro CRM: $30 per user per month (monthly) $24 per user per month (yearly)

- Enterprise CRM: upon request

There’s also a 14-day free trial available.

Why Use Monday.com For Team Collaboration?

Since monday.com originally started as a project management solution, the CRM includes plenty of team collaboration tools perfect for managing multiple insurance agents and improving communications.

For instance, the platform offers Whiteboards for brainstorming sessions, embedded documents where insurance agents can share and work on docs for easier document management, and more.

What’s Missing?

The platform lacks customer service tools and industry-specific templates for insurance agencies.

Zendesk Sell

Zendesk is a sales and service platform that prioritizes ease of use. Zendesk Sell, the platform’s CRM software is easy to get into, while still managing to bring quite a few handy features to the table, like AI capabilities, built-in chatbots, and more.

Top Features

- Lead generation tools

- Customer self-service portals

- Phone calls functionalities

- Built-in text and email marketing

- Lead and deal scoring

Pricing

- Team: $19 per user per month

- Growth: $49 per user per month

- Professional: $99 per user per month

- Enterprise: $150 per user per month

All pricing plans are billed yearly. There’s also a free trial available for all plans, except the Enterprise package.

Why Use Zendesk For Improving Lead Communications?

Zendesk Sell allows you to reach out to leads across multiple channels, including emails, texts, social media, and phone calls. Moreover, the platform’s AI tools can provide phone script suggestions to help insurance agents close faster.

Additionally, the platform covers call tracking and recording, bulk emailing with tracking, text messaging, automated power dialers, and more.

What’s Missing?

Although Zendesk includes financial services-specific CRM software mentioned in their product offerings, the platform lacks insurance industry-specific functionalities, like policy tracking and other insurance management tools.

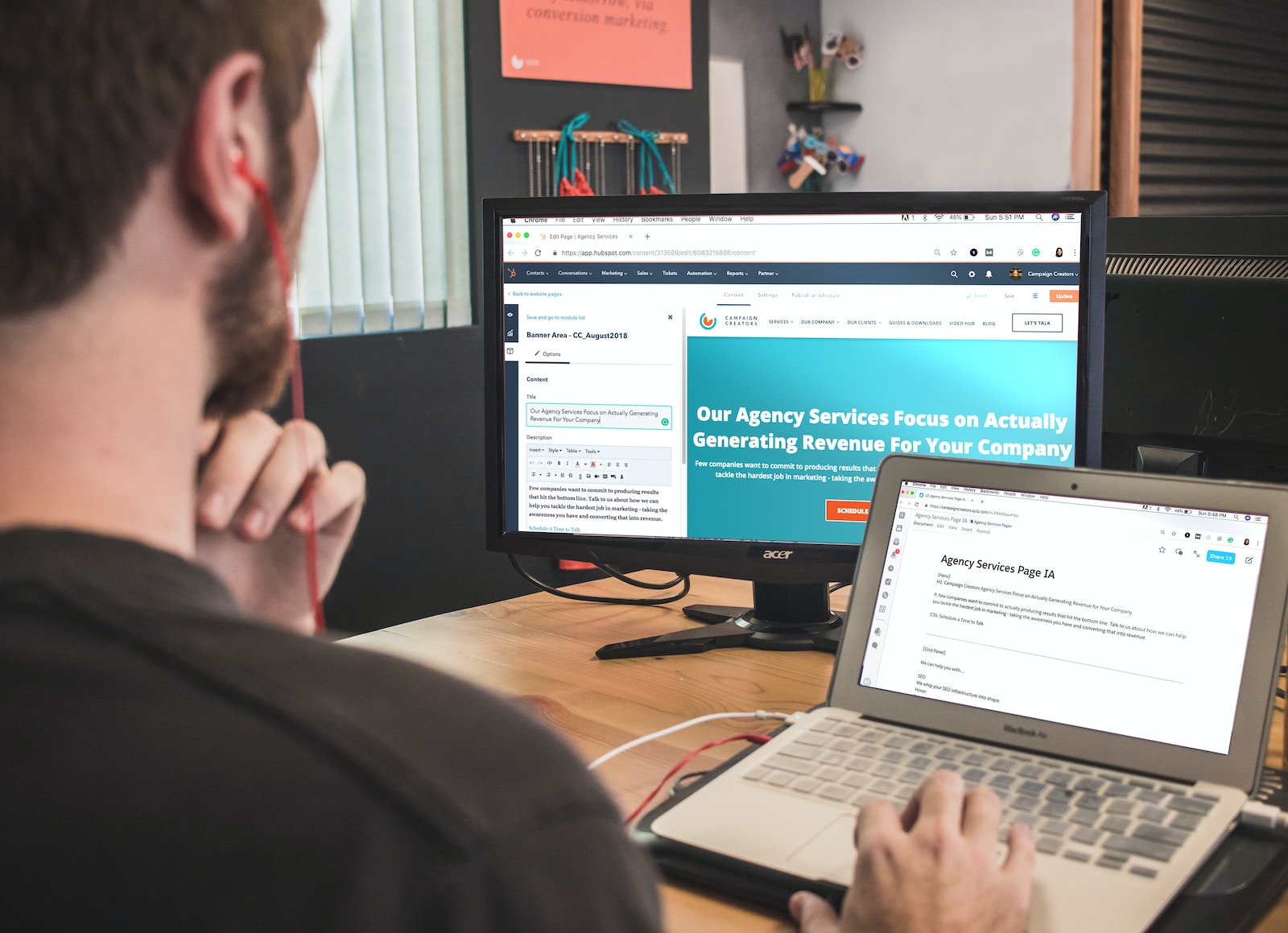

HubSpot

HubSpot‘s CRM software is found in the platform’s Sales Hub. Besides the CRM itself, the platform includes various email marketing and document management tools, a landing page builder, and more.

And the cherry on top, you can start using HubSpot completely for free with unlimited users.

Top Features

- Lead and deal management

- Sales and marketing automation

- Built-in phone calling features

- Unified communications

- In-depth analytics

Pricing

- Free (unlimited users)

- Starter: $50 per month (monthly), $45 per month (yearly)

- Professional: $500 per month (monthly), $450 per month (yearly)

- Enterprise: $1200 per month (yearly)

Why User HubSpot For Free?

HubSpot CRM is one of the most in-depth free solutions in the market. As mentioned, besides CRM features, you also have access to a landing page builder with embedded forms, email marketing tools, and chatbots to help with lead generation, ad management tools, etc.

What’s Missing?

HubSpot does not cover an insurance-specific CRM, while customization options are limited in the free plan. As such, tweaking the CRM to meet your specific needs might be a challenge.

Keap

Keap is an all-in-one sales and marketing platform that emphasizes automation capabilities. Aside from that, this platform also covers landing pages, text marketing, appointment management, and more.

Top Features

- Insurance upsell campaigns

- Policy renewal alerts

- Automatic follow-ups

- Lead and contact management

- Quote/invoice management

Pricing

- Pro (up to two users): $169 per month (monthly), $129 per month (yearly)

- Max (up to three users): $249 per month (monthly), $199 per month (yearly)

- Max Classic: upon request

There is also a 14-day free trial available for the Pro and Max plans.

Why Use Keap For Automating Workflows?

Keap comes packed with automation features designed to eliminate monotonous tasks and improve the productivity of sales teams.

For instance, you can create automated text and email follow-ups and set up automated processes for your landing pages, email marketing campaigns, and more.

What’s Missing?

Keap has a high learning curve, and it might be difficult to get started with.

Maximizer

Maximizer is another all-in-one platform that packs sales, marketing, and customer service functionalities into a straightforward solution.

The platform also covers plenty of insurance-specific functionalities. Some of its key features include policy management, activity tracking for insurance agents, and more.

Top Features

- Agent management and tracking

- Policy tracking and rating

- Referral marketing

- Lead generation tools

- Case management

Pricing

- Small Office Edition: $35 per user per month

- Business Edition: $55 per user per month

- Professional Edition: $100 per user per month

Note that all pricing plans are billed annually. You can also book a live demo for free.

Why Use Maximizer For Accelerating Sales?

As the name suggests, this platform’s main goal is to help you accelerate sales. The platform comes with in-depth customization options to help you eliminate any distractions and focus on what matters the most, generating more sales.

Moreover, Maximizer gives you all the features necessary to generate and nurture leads, monitor the activity of your insurance agents, and gather in-depth insights regarding your company’s sales activities — All of which are crucial for boosting sales.

What’s Missing?

Most users report that the platform’s interface can get clunky.

ACT!

ACT! is CRM software packed with powerful marketing-oriented features.

The platform includes customizable sales pipelines, lead scoring, and activity management, along with 170+ email templates, email campaign tracking, website activity tracking, and more. As such, ACT! is the best insurance CRM with marketing capabilities.

Top Features

- Lead management and lead scoring

- In-depth customizable reports

- Customer relationships timelines

- Built-in phone features

- Drip campaign builder

Pricing

- Premium Desktop (on-premise): $37.50 per user per month

- Premium Cloud: $30 per user per month

- Premium Cloud With Desktop Sync: $40 per user per month

All pricing plans are billed yearly. There’s a 14-day free trial available.

Note that most marketing automation features come as optional add-ons. In that case, there are three more packages:

- Marketing Automation Select: $59.25 per account per month

- Marketing Automation Complete: $149.25 per account per month

- Marketing Automation Advanced: $299.45 per account per month

Why Use ACT! For Marketing Automation?

ACT! covers some of the most comprehensive marketing automation functionalities in this list. More specifically, you have access to turnkey and drip campaigns, built-in A/B tests, website activity tracking, event marketing, social media sharing, and more.

These email marketing functionalities are excellent for cross-selling new insurance products or services, offering extra coverage, or for quickly sending customers policy renewal reminders and policy change notifications. You can also send welcome, thank you, and birthday emails to strengthen customer relationships.

What’s Missing?

The platform lacks insurance CRM-specific features, like insurance policy management and tracking or referral marketing, for instance.

Zoho CRM

Zoho CRM is designed with small businesses and remote workers in mind. It prioritizes ease of use, while insurance agents can use the Zoho CRM mobile app to access and edit CRM data online and offline, track activities, etc.

However, Zoho CRM shines through its customer communication capabilities, which we’ll discuss a bit later.

Top Features

- Claim management

- AI sales assistant

- Sales and marketing automation

- Integrations with phone calling apps via Zoho Marketplace

- Lead and contact management

Pricing

- Free (up to three users)

- Standard – $20 per user per month (monthly), $14 per user per month (yearly)

- Professional – $35 per user per month (monthly), $23 per user per month (yearly)

- Enterprise – $50 per user per month (monthly), $40 per user per month (yearly)

- Ultimate – $65 per user per month (monthly), $52 per user per month (yearly)

There’s also a 15-day free trial available for all pricing plans.

Why Use Zoho CRM For Customer Communication?

Zoho CRM allows insurance agents to stay in touch with customers across multiple channels.

The platform allows you to reach customers via email, phone, live chat, and email. Zoho’s email functionalities include both direct and bulk emails.

Zoho CRM will also keep track of past customer interactions and offer real-time notifications to help address customers’ needs as quickly as possible.

That said, this is an excellent software system for insurance agents looking to improve customer relationships and keep leads engaged.

What’s Missing?

Most customization options of Zoho CRM are locked behind higher-tiered pricing plans. As such, it might be a little tricky to make this platform work seamlessly for insurance agencies.

Freshsales

Formerly known as Freshworks CRM, Freshsales is a CRM platform with advanced customization and AI capabilities.

As such, insurance agencies can easily customize the platform according to their needs, while its AI-powered tools help identify and focus on high-value leads as well as provide crucial business insights.

Top Features

- Lead and contact management

- Lead scoring

- Built-in phone and SMS features

- Automated workflows

- AI chatbots

Pricing

- Free

- Growth: $18 per user per month (monthly), $15 per user per month (yearly)

- Pro: from $47 per user per month (monthly), $39 per user per month (yearly)

- Enterprise: $83 per user per month (monthly), $69 per user per month (yearly)

There’s also a 21-day free trial available for all pricing plans.

Why Use Freshsales For Customization?

Although Freshsales is not a dedicated CRM software for insurance agents, the platform’s customization options can make it feel like one.

Freshsales allows you to customize the contact and accounts details page to highlight specific customer details, open customer support tickets, files, etc.

Aside from that, you can create customized sales and email campaigns, or tweak web forms to capture crucial customer information.

What’s Missing?

Freshsales lacks features like insurance policy management and tracking, policy rating, renewal alerts, etc.

Insureio

Unlike the other tools mentioned above, Insureio is a CRM system specifically designed for the insurance industry. The platform emphasizes marketing and insurance agency management operations.

As such, this CRM system covers features like customizable email templates with pre-built email marketing campaigns, agency recruiting, hierarchy management, and more.

Top Features

- Policy management

- Built-in phone dialer

- Agent recruiting tools

- Email marketing tools

- Lead routing

Pricing

- Basic: $25 per month

- Marketing: $50 per month

- Agency Management: $50 per month

- Marketing and Agency Management: $75 per month

Note that all pricing plans are billed monthly. There’s also a 30-day free trial available for all pricing plans.

Why Use Insureio For Agency Management?

Insureio is one of the few tools in the market that covers insurance agency operations management. As mentioned, this CRM solution offers agent recruiting features with recruiting email templates.

Moreover, the platform allows you to easily manage policies, and organize documents, while its e-policy delivery feature helps you apply and deliver policies to clients electronically.

What’s Missing?

Insureio lacks in the integrations department. You have no option to link the platform with Zapier, while its native integrations are limited to social media and carrier quoting systems.

Radius

Radius is another CRM software for insurance agents. This CRM solution covers sales and marketing automation functionalities, like lead distribution rules, automatic workflows, autoresponders, email marketing, and more.

However, this platform stands out due to its VoIP and call center features. Insurance agencies get access to a built-in VoIP system with call recording, queue lists, local and toll-free numbers, etc.

Top Features

- Lead and client management

- Marketing tools

- Built-in VoIP phone system

- Agent recruitment

- E&O and license tracking

Pricing

- Agent (up to 1 user): $34 per month (without VoIP), $78 per month (with VoIP)

- CSR (up to 2 users): $68 per month (without VoIP), $156 per month (with VoIP)

- Broker (up to 5 users): $149 per month (without VoIP), $369 per month (with VoIP)

- Agency (up to 10 users): $292 per month (without VoIP), $732 per month (with VoIP)

Note that all pricing plans are billed monthly.

Why Use Radius For VoIP Functionalities?

Radius is the best insurance CRM in this regard. Insurance agencies can easily make and record calls, set interactive voice responses and call groups, or get access to click-to-call and preview auto-dialers directly within the CRM.

What’s Missing?

The platform is quite pricey. Moreover, pricing plans do not necessarily differ by the number of features they provide, but by the number of users they can accommodate. Aside from that, Radius lacks policy management functionalities.

AgencyBloc

AgencyBloc is a little more niched compared to the other platforms in this list. More specifically, this CRM solution is specifically designed for life insurance and health insurance agencies.

As such, this platform requires little to no customization for insurance companies operating in this niche.

Top Features

- Policy management

- Commissions processing and reporting

- Sales and lead management

- Automatic workflows

- In-depth reports

Pricing

Pricing starts from $70 per month (billed monthly). However, you’ll need to get in touch with the sales team to create a customizable plan according to your needs. There’s also a 7-day free trial available.

Why Use AgencyBloc For Life Insurance and health insurance?

As stated, health and life insurance companies barely need to customize the platform to fit their needs. Aside from that, the platform integrates with other life and health insurance software like Ease, for instance.

What’s Missing?

Users report that the platform can sometimes get clunky.

VanillaSoft

VanillaSoft is a CRM solution that specializes in lead management. The platform emphasizes sales activity reports and insights so insurance agents can get all the lead and sales information necessary to make data-driven decisions.

Additionally, VanillaSoft allows you to reach leads via multiple communication channels, while the platform prioritizes leads automatically, handles appointment scheduling, and more.

Top Features

- Lead prioritization

- Lead routing and queuing

- Appointment scheduling

- Agent recruitment and tracking

- Automatic workflows

Pricing

Pricing starts at $80 per month (billed monthly). However, you’ll need to contact the sales team to get a customized pricing quote. You can also schedule a free demo.

Why Use VanillaSoft for Lead Management?

VanillaSoft automates most repetitive tasks, like sending follow-ups, scheduling appointments, or managing lead lists, to help you focus more on going after high-value leads.

Moreover, the platform automatically prioritizes leads as they enter the system. You can also easily import your leads from web forms, chatbots, Facebook, etc. without any headaches at all.

What’s Missing?

The platform has a steep learning curve, and it lacks some insurance-specific features, like policy management or commission processing.

CRM Software for Insurance Industry: Conclusion

These were the top 15 best insurance CRM platforms currently available. Generally speaking, CRM solutions that are not built with insurance businesses in mind tend to have more free versions available.

That said, if you’re looking to get your feet wet with CRM solutions, it’s best to start with free software like HubSpot, Zoho, or Freshsales, for instance.

However, keep in mind that insurance agencies might need to spend a little time customizing these platforms to your needs, and you won’t have access to insurance-specific functionalities.

On the other hand, if you already have some experience with CRMs, consider sticking with platforms specifically built for insurance businesses, as they cover more industry-specific features.

They also might bring you better value for money, since pricing is not done on a per-user basis for most of these platforms.